Exchange-traded funds (ETFs) have become increasingly popular in recent years as a way for investors to gain exposure to various sectors and asset classes. The ETFs offer investors the benefits of diversification, low fees, and flexibility in trading. However, have you ever wondered which ETFs have stood the test of time and have been around the longest?

In this article, we will explore the 10 oldest ETFs in the world and take a closer look at their history, performance, and overall significance in the world of investing. Whether you are a seasoned investor or just getting started, this list is sure to provide valuable insights into the evolution of ETFs and their impact on the investment landscape.

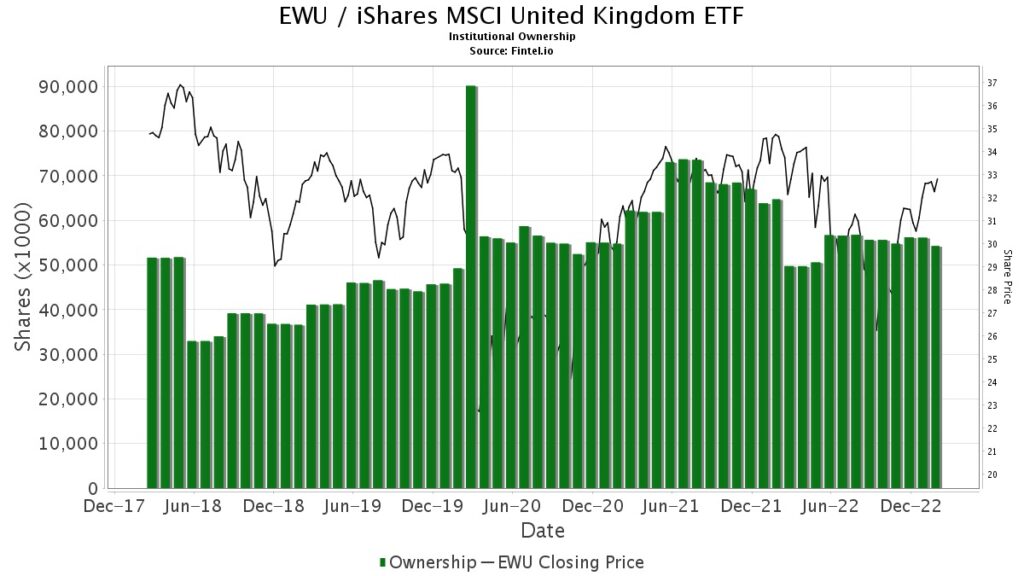

10. iShares MSCI United Kingdom ETF

Year Launched: 1996

Symbol & Snapshot: EWU

Annualized Return: 2.99%

Average Return: Unspecified

The iShares MSCI United Kingdom ETF (EWU) was launched in March 1996 by Barclays Global Investors, which later merged with BlackRock. At the time of its launch, EWU was one of the first ETFs to provide investors with exposure to the UK equity market. The fund was designed to track the performance of the MSCI United Kingdom Index, which includes large and mid-cap companies in the UK.

Over the years, EWU has experienced periods of both growth and decline, reflecting the volatility of the UK equity market. For example, during the financial crisis of 2008-2009, the fund saw a significant decline in value as many UK companies struggled in the face of economic uncertainty. However, in the years since, the fund has rebounded, reflecting the overall recovery of the UK economy and the performance of UK companies.

Did You Know?

The fund has over $2 billion in assets under management and is one of the largest ETFs focused on the UK market.

9. iShares MSCI Singapore ETF

Year Launched: 1996

Symbol & Snapshot: EWS

Annualized Return: 10.79%

Average Return: Unspecified

The iShares MSCI Singapore ETF (EWS)‘s objective as a fund was to offer investors a means of gaining exposure to the Singapore equity market by tracking the performance of the MSCI Singapore Index, which comprises large and mid-cap companies in Singapore.

At the time of its inception, EWS was among the first ETFs that provided investors with a specific focus on the Singapore market. Since then, the fund has gained popularity as Singapore has developed into a hub for global finance and a center for innovation and technology.

Did You Know?

Presently, EWS is one of the largest ETFs that concentrate on the Singapore market, with assets under management of over $3 billion.

8. iShares MSCI Mexico Capped ETF

Year Launched: 1996

Symbol & Snapshot: EWW

Annualized Return: Unspecified

Average Return: Unspecified

The iShares MSCI Mexico Capped ETF (EWW) is an exchange-traded fund that seeks to track the investment results of the MSCI Mexico IMI 25/50 Index, which includes a broad range of Mexican stocks. EWW is designed to provide investors with targeted exposure to the Mexican equity market, which is the second-largest economy in Latin America.

The fund invests in a diversified portfolio of Mexican companies, including those from the financial, consumer, healthcare, and energy sectors. As of 2021, the fund’s largest holdings include stocks from companies like FEMSA, América Móvil, and Grupo Aeroportuario del Sureste. EWW has become one of the largest ETFs focused on the Mexican market, with over $700 million in assets under management as of 2021.

Did You Know?

The fund’s management fee is 0.49%, which is relatively low compared to other actively managed mutual funds focused on the Mexican market.

7. iShares MSCI Japan ETF

Year Launched: 1996

Symbol & Snapshot: EWJ

Annualized Return: 2.33%

Average Return: Unspecified

The iShares MSCI Japan ETF (EWJ) is a popular exchange-traded fund that provides investors with exposure to the Japanese equity market. Japan is known for its innovative and technologically advanced companies, and EWJ’s portfolio includes companies such as Sony, SoftBank Group, and TDK. This makes the fund potentially attractive for investors who are interested in investing in Japan’s cutting-edge technology sector.

Additionally, EWJ’s expense ratio is relatively low compared to actively managed mutual funds focused on Japan, which makes it a popular choice for cost-conscious investors. However, like any other equity market, the Japanese equity market can be volatile and subject to currency fluctuations, so investors in EWJ should be prepared for potential fluctuations in the fund’s performance.

Did You Know?

As of 2021, EWJ has over $16 billion in assets under management, making it one of the largest ETFs focused on Japan.

6. iShares MSCI Hong Kong ETF

Year Launched: 1996

Symbol & Snapshot: EWH

Annualized Return: 4.64%

Average Return: 2.55%

The iShares MSCI Hong Kong ETF (EWH) is a popular exchange-traded fund that was launched in March 1996 by Barclays Global Investors, which later merged with BlackRock. EWH tracks the performance of the MSCI Hong Kong Index, which includes large and mid-cap companies in Hong Kong. This includes companies from various sectors, such as financials, real estate, and telecommunications.

As of 2021, the fund has over $3 billion in assets under management. Hong Kong is known for its financial industry and is a hub for international trade, making it an attractive market for investors seeking exposure to emerging markets. EWH’s portfolio includes companies such as HSBC Holdings, Tencent Holdings, and China Mobile.

Did You Know?

EWH has a relatively low expense ratio of 0.51%, which makes it an attractive option for investors seeking cost-effective exposure to Hong Kong’s equity market.

5. iShares MSCI Germany ETF

Year Launched: 1996

Symbol & Snapshot: EWG

Annualized Return: 1.40%

Average Return: 2.44%

EWG provides investors with a convenient and cost-effective way to gain exposure to Germany’s equity market. The fund can be bought and sold like a stock on major exchanges and has a relatively low expense ratio compared to actively managed mutual funds focused on Germany. The fund’s performance is affected by various factors, such as economic conditions in Germany, changes in currency exchange rates, and global market trends.

The fund has gone through periods of growth and decline over the years due to changes in these factors. For example, the fund experienced a decline in performance during the global financial crisis in 2008 but saw significant growth in the following years as the German economy recovered.

Did You Know?

The ETF holds a diversified portfolio of German equities, with a focus on large-cap companies. As of February 28, 2023, the ETF held 59 stocks, with the largest holdings being SAP, Siemens, and Allianz.

4. iShares MSCI Canada ETF

Year Launched: 1996

Symbol & Snapshot: EWC

Annualized Return: 20.84%

Average Return: 4.44%

The iShares MSCI Canada ETF is an exchange-traded fund managed by BlackRock that provides exposure to Canadian equities. It was launched in 1996 and tracked the performance of the MSCI Canada Index, which is a market capitalization-weighted index that measures the performance of the Canadian equity market. Its top holdings include financial institutions like the Royal Bank of Canada and Toronto-Dominion Bank, as well as energy companies like Enbridge and Canadian Natural Resources.

The iShares MSCI Canada ETF provides investors with exposure to a variety of sectors, including financials, energy, materials, and consumer staples. With an expense ratio of 0.51%, the fund is relatively low compared to other Canadian equity ETFs. Investors can buy and sell shares of the iShares MSCI Canada ETF on major stock exchanges, such as the New York Stock Exchange and the Toronto Stock Exchange.

Did You Know?

As of September 2021, the fund had over $10 billion in assets under management and has a diversified portfolio of over 100 Canadian companies.

3. iShares MSCI Australia ETF

Year Launched: 1996

Symbol & Snapshot: EWA

Annualized Return: 3.55%

Average Return: Unspecified

The iShares MSCI Australia ETF is an exchange-traded fund managed by BlackRock that provides exposure to Australian equities. It tracks the performance of the MSCI Australia Index, a market capitalization-weighted index that measures the performance of the Australian equity market. Its top holdings include financial institutions like Commonwealth Bank of Australia and Westpac Banking Corp, as well as mining companies like BHP Group and Rio Tinto.

The iShares MSCI Australia ETF provides investors with exposure to a variety of sectors, including financials, materials, and healthcare. With a low expense ratio of 0.50% and a relatively high dividend yield of around 3%, it is a popular choice among investors who are looking for exposure to the Australian market.

Did You Know?

Australian equities have historically provided investors with attractive risk-adjusted returns, and the iShares MSCI Australia ETF provides a low-cost, diversified way to invest in the Australian equity market.

2. SPDR S&P MidCap 400 ETF

Year Launched: 1995

Symbol & Snapshot: MDY

Annualized Return: 9.52%

Average Return: 26.20%

The SPDR S&P MidCap 400 ETF is an exchange-traded fund managed by State Street Global Advisors that provides exposure to mid-cap U.S. equities. It tracks the performance of the S&P MidCap 400 Index, which measures the performance of mid-cap companies in the U.S. equity market. The fund has a diversified portfolio of over 400 mid-cap companies, with its top holdings including companies like Align Technology, HubSpot, and Dexcom. It provides investors with exposure to a variety of sectors, including healthcare, technology, and consumer discretionary.

With an expense ratio of 0.23%, the SPDR S&P MidCap 400 ETF is relatively low-cost compared to other mid-cap equity ETFs. Mid-cap equities have historically provided investors with attractive risk-adjusted returns, and the SPDR S&P MidCap 400 ETF provides a low-cost, diversified way to invest in this segment of the U.S. equity market.

Did You Know?

Investors can buy and sell shares of the SPDR S&P MidCap 400 ETF on major stock exchanges, such as the New York Stock Exchange and the NASDAQ.

1. SPDR S&P 500 ETF

Year Launched: 1993

Symbol & Snapshot: SPY

Annualized Return: 10.77%

Average Return: 27.33%

Launched in 1993, the SPDR S&P 500 ETF is considered the oldest exchange-traded fund managed by State Street Global Advisors that provides exposure to large-cap U.S. equities and is considered the oldest ETF in existence. The fund tracks the performance of the S&P 500 Index, which measures the performance of the 500 largest publicly traded companies in the U.S. The SPDR S&P 500 ETF has a diversified portfolio of over 500 large-cap companies, including top holdings such as Apple, Microsoft, and Amazon.

It provides investors with exposure to a variety of sectors, including technology, healthcare, and consumer discretionary. The fund has an expense ratio of 0.09%, which is relatively low compared to other large-cap equity ETFs. Large-cap equities have historically provided investors with long-term growth potential and income, making the SPDR S&P 500 ETF a popular choice for investors looking for exposure to the U.S. equity market.

Did You Know?

The fund is structured as a unit investment trust (UIT), which means that it holds a fixed portfolio of securities and does not engage in active trading or stock picking.